Mastercard buys Irish Payments company Orbiscom for $100m

2009 off to a flying start.

Orbiscom acquired by Mastercard for $100m according to

Irish Times article

Great turnaround by Orbiscom team – as they were written off a few years back.

2009 off to a flying start.

Orbiscom acquired by Mastercard for $100m according to

Irish Times article

Great turnaround by Orbiscom team – as they were written off a few years back.

The fab designer of Web2Ireland, James Gallagher, just contacted me about the re-launch of LiveWebStars and their partnering with one of my fave web-sites, DownloadMusic.ie.

Livewebstars.tv promotes new music by enabling up-and-coming artists to perform and interact using live on-line streaming – broadcasting their lives, practice sessions, gigs etc to an audience right around the globe.

By working together with DownloadMusic, they enable consumers to buy mp3s with their mobile phone and also watch, hear and chat to the band in real time.

This is the sort of smart partnering that makes complete sense. It benefits everyone involved and will be of huge benefit to Indie Bands trying to get noticed and differentiate themselves.

Whilst the funding environment is very very tough right now, we are still seeing glimmers of light in the gloom.

The latest is dbTwang, a site for guitar owners, which closed its Angel round yesterday. Keith Bohanna and co-founder Fintan Blake-Kelly worked for many months with new director Gerry McQuaid (ex-O2) to raise the funds.

They are using Contrast for the design of dbTwang and Lunar Logic in Krakow for the development, aiming for early closed beta around the 3rd week of February.

If you have any good news on the funding front, drop a line to web2ireland DOT editor AT gmail DOT com

Speaking at a press conference in Dublin Castle, Taoiseach Brian Cowen, announced a range of measures to boost the economy – through a new renewal programme – around “Building Ireland's Smart Economy -

A Framework for Sustainable Economic Renewal” – see press release and pdf document on report.

=====================

Some interesting nuggets from the report

Up to €500 million will be generated to create a venture fund, known as 'Innovation Fund Ireland', to support early stage R&D-intensive SMEs. The capital will be divided into five venture funds of between €75-150 million; [see previous post on VC funding in Ireland]

More favourable tax treatment of the carried interest of venture capital is being introduced at a rate of 15% for partnerships and 12.5% for companies to encourage the availability of so-called 'smart capital' for investing in start-up innovative companies who will be the employers of the future;

Entrepreneurship, business start-ups and employment creation will be driven by a number of highly-favourable taxation measures including exemption from corporation tax arising in the first three years of operation for business start-ups, a tax abatement scheme for restricted shares, and a refund in the case of forfeited shares, to

assist companies, including start-up companies, in retaining key employees;

Venture capital investment is still relatively under-developed in Ireland. When defined as formal investment outside public capital markets, which represents total start-up, expansion and buyout investments, Ireland ranks 12th in the EU-15 in this regard;

Ireland ranks 4th across the OECD and 2nd in Europe for the proportion of early stage entrepreneurs with 8.2% of adults in Ireland engaged in entrepreneurial activity in 2007 up from 7.4% in 2006;

High concentration of leading high-tech multinationals many of which have facilitated a huge technological transfer from Silicon Valley to Ireland;

Ireland is ranked as 7th out of 182 countries as a place to do business; the 5th easiest place to establish a business; and the 3rd cheapest location for starting a business. Enterprise Ireland has a strong system to support high-potential start-up enterprises and a growing international presence;

'Smart capital' can be defined as (a) adequate levels of early stage funds for SMEs; (b) providing value-added networks to key decision-makers; and (c) experienced investment managers. European venture funds have performed relatively poorly in comparison to US funds and so it remains difficult to attract the best (Tier 1) VCs from the US. Nevertheless, it is these types of VCs that provide the best possible networks and management experience that can develop Irish-based companies.

Just as Ireland fashioned itself to become the destination of choice for multinational enterprises, the vision is to establish Ireland as The Innovation Island through: Continued substantial investment in science and technology infrastructure and research; A substantial investment in early stage venture capital to commercialise and capitalise on this investment, similar to the Israeli Yozma Fund; The attraction of experienced and top-tier venture partners (including those described as Tier 1 VCs) operating independently to manage to raise capital and focus on deal-flow creation;

To attract high-quality mobile entrepreneurs to set up businesses in Ireland and to assist start-up companies to retain employees, we are providing for a tax abatement scheme for restricted shares;

===========================

Also check Irish Times coverage

Now for some community feedback – please comment on this new framework….

Techcrunch France editor – and LGiLab VC in Israel – Ouriel Ohayon has a great piece on Can governments become good VCs?

This topic came up in VC discussion at last week’s LeWeb – and Ireland was mentioned as an example.

Enterprise Ireland in a June press release provided an update on the 2007-2012 Seed and Venture Capital (VC) Programme

To date €148.75m has been committed to 8 Seed & Venture Funds.

Of these, 6 have completed first closings, including

- Delta Partners [100m fund]

- AIB Seed Capital Fund [30m fund]

- Atlantic Bridge Ventures

- Kernel Capital Partners [70m fund]

- Fountain Healthcare Partners – not for technology – life science fund.

- NCB Ventures – [75m fund] – closed its fund in November.

€275m funds readily available – and from EI press release – 8 funds [2 funds still to close] have succeeded in raising in excess of €500m for investment in early stage and growing companies.

Enterprise Ireland announced that €30m is remaining and is now available for co-investment – and a recent advertisement in the FT is targetting UK VCs for partnership.

Given the recent UK news @ Government funds for NESTA, the UK's National Endowment for Science, Technology and the Arts, will oversee a £1bn emergency venture capital fund aimed at pre-revenue technology start-up firms – and the follow on discussion – We’d like to hear from Web2Ireland companies who have raised monies from these EI backed funds [make sure you update your Crunchbase details]

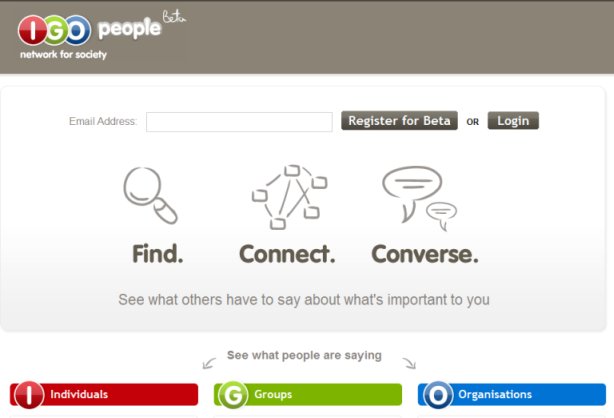

I was thrilled to hear from Campbell Scott that IGOpeople is in public beta starting today. They’ve been in stealth mode for a long time and we’ve all been looking forward to seeing it in action.

Campbell describes it as:

a Network for the Real World that brings people together to Find, Connect and Converse, with their friends and with the businesses and organisations they deal with.

Sounding like a very useful mix of Social Networking, discussion boards, GetSatisfaction and UserVoice, it looks like a great way for companies to see what people have to say about them.

I had a pleasure of attending LeWeb last week – and here are the top 10 takeaways

Meeting Irish in attendance

Very low Irish presence – Pat Phelan from Maxroam, Conor O’Neill from Loudervoice [who also covered event for ReadwriteWeb]

- Brian Bastible and colleagues from IDA

Connecting with People

Lots of great folks attending from the US, UK, Germany, France and Spain.

Old School is best school

Got to meet and chat with Dennis, Doc and JP.

Glimpse of future

Dave Morin – facebook connect, Marissa Mayer – Google, and Susan Wu – Virtual Goods

Startups – no Irish… come on !!

Startup Competition – some interesting startups – and very worthy winner – some Web2Ireland companies would have done well at this event….

Failure – true stories

Morten Lund was one highlight of the event – off the cuff – very honest in his story.

Funding is hard in Europe

Lots of VCs in attendance [none from Ireland] – and the VC panel was interesting – see video. Key themes – build products that VCs will use [Fred Wilson, Martin Varsasky, Jeff Clavier] – and they don’t really believe Govt intervention @ funding is key [more on that later] – and NO doesnt mean NO.

Go Big or Go Home

Lots of usual talk @ valley versus Europe and can we build a big European web company.

Annual LeWeb bitch fight

Great fun from the sideline

Next Year

Rumour has it that the International D Conference will happen in Dublin next year

And no doubt LeWeb 09 will be another enjoyable event.

Anton has the details on the Innovate Media event tomorrow

In partnership with the Media Cube at IADT, its a Mini-conference, networking event and breakfast for digital media companies focusing on those who have come through the many incubation centres around the country.

When: Wednesday the 17th of December commencing at 8.30 a.m. There is no attendance fee and breakfast will be provided.

Where: The Media Cube, IADT, Dun Laoghaire.

I met up with Mike Sigal from Guidewire Group this week at LeWeb in Paris – and he updated me on the new Innovate Europe event they are running.

In a nutshell Mike, Chris and their team are

- Running regional “Auditions” in Europe to meet and talk to startups [22nd Jan, Dublin]

- Selected startups are invited to the Innovate!Europe's Master Class [4-6 May 2009 in Zaragoza, Spain]

- Also participate in Innovate!Europe Trade Mission – that will visit Silicon Valley in June 2009

- One European startup will win an exclusive spot at Guidewire STUDIO, an in-residence business accelerator in the heart of Silicon Valley.

I would recommend all Web2Ireland companies to apply for Innovate!Europe

CrunchBase have launched a mashup of their company data CrunchVision.com. To get your company on the map – fill in the address field in CrunchBase.

Note: CrunchBase is a wiki format (anyone can edit). If you know of a company, not marked on the map – you can edit their address yourself.