“Most SaaS founders are not underpricing or overpricing. They are mis-pricing the customer, the value, and the timing.”

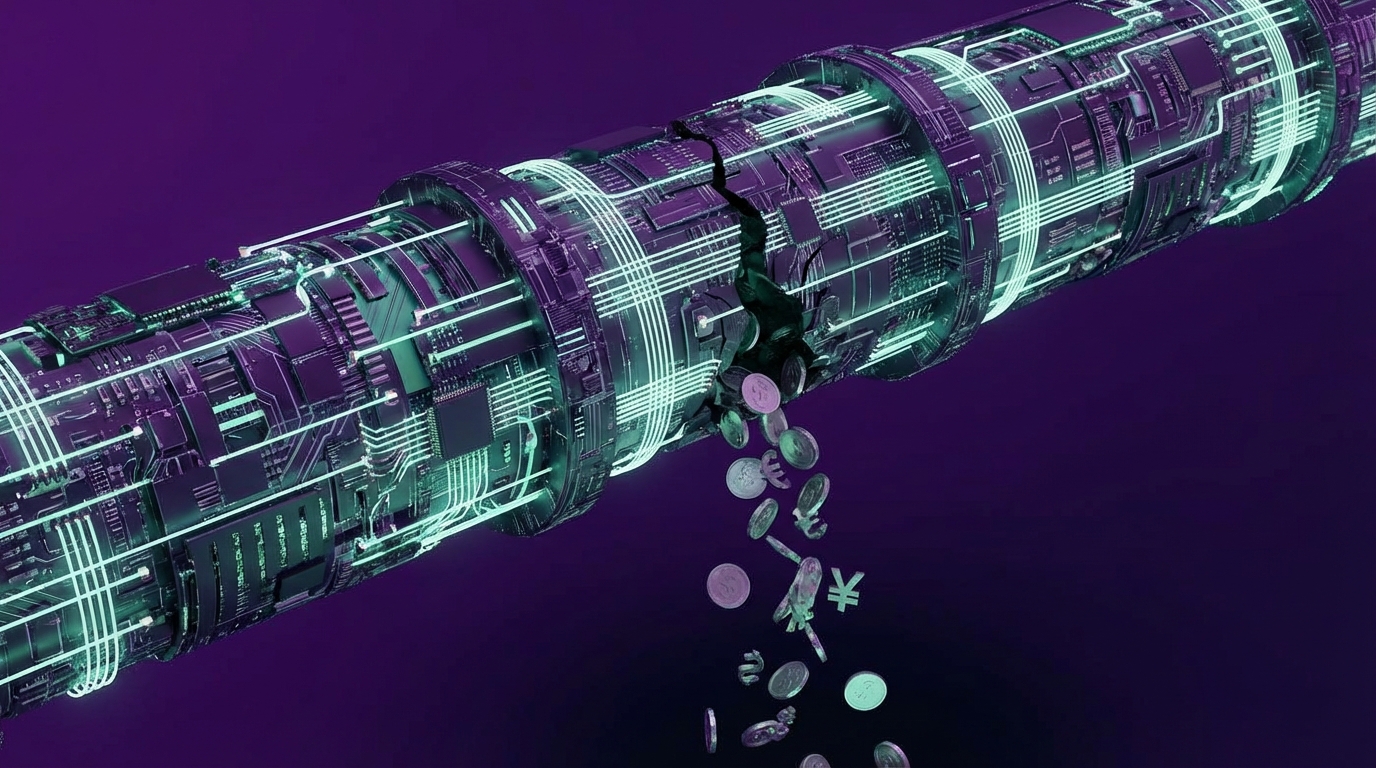

Revenue is leaking from your SaaS not because the product is bad, but because the pricing strategy is structured to please everyone and convert no one at full value. The market shows a consistent pattern: SaaS companies that treat pricing as a living growth lever see 20 to 40 percent higher ARPU within 12 to 18 months, while flat, “set it and forget it” pricing holds revenue hostage and distorts customer quality.

Investors look for one thing in your pricing: proof that you understand who is buying, why they buy, and how much value you create per unit of time. The price is not the story. The behavior your price creates is the story. The trend is not clear yet for every niche, but across B2B SaaS the signals are strong: the winners reprice, repackage, and re-segment faster than their peers, because they treat pricing as a product, not a PDF on the website.

Your current SaaS pricing is probably losing you money in three compounding ways. First, you anchor your packages around features instead of outcomes, which caps willingness to pay. Second, you structure tiers in a way that pushes serious buyers into discounted plans or feature bloat instead of upsell paths. Third, you fail to link price to usage or success metrics, so your highest-value customers look exactly like your free-trial tourists in your billing system. That is where growth dies quietly.

The market does not reward vague value. It rewards clear, consistent pricing logic that your target buyer can explain to their CFO in one sentence. When the buyer cannot do that, they push for discounts, stall deals, or downshift into a cheaper plan “for now.” Your net revenue retention then flattens, even if logos go up and churn looks fine on paper.

Pricing is a behavioral tool. It shapes how customers adopt the product, when they expand, and how your own sales team spends its time. If your AE spends more time explaining why the “Pro” plan exists than talking about ROI, the model is working against you. If your self-serve users hit a random limit and churn instead of upgrading, the model is costing you CLTV every day.

“Pricing is long-term product-market fit expressed as a number. If customers love you and margins still hurt, pricing is the broken part.”

Your board will not accept “the market is price sensitive” as a reason forever. In B2B, the company that prices with intent usually wins over the one that prices with fear. The gap between those two mindsets shows up in your P&L as a very real, very measurable revenue shortfall.

How SaaS Pricing Quietly Destroys Margin

The common story in SaaS is simple. Signups are steady, churn is not terrible, NPS looks fine, yet cash feels tight and expansion revenue is weak. Founders blame marketing, sales performance, or product gaps. Many times, the root issue sits in a static pricing page designed in the first year and never stress-tested again.

Investors look first at gross margin, net revenue retention, and sales efficiency. Those numbers are not only about cost or closing skill. They are also about where you sit on the customer’s value curve. If your pricing does not move in sync with that curve, you create three silent drains on money:

1. High-value users paying low-value rates for too long.

2. Low-intent users clogging support and infrastructure at subsidized prices.

3. Mid-market or enterprise users stuck in self-serve tiers that do not match their budget or internal buying process.

The market indicates that early-stage SaaS founders anchor price on competitors or gut feeling. Growth-stage leaders anchor price on willingness to pay and clear segmentation. That gap in approach means two startups with similar products can have very different revenue outcomes over five years.

“Most SaaS teams treat the pricing page as a branding asset. CFOs treat it as a capital allocation decision. The second lens usually wins in the long run.”

Then vs Now: Why Old SaaS Pricing Habits Fail In 2025

A lot of SaaS pricing thinking is still stuck in 2010: three neat tiers, per-seat billing, a big “Contact Us” button. That model came from the early wave of subscription tools where IT managers rolled out licenses across teams.

The market structure in 2025 looks different. Budgets are tighter, buyer groups are larger, and most customers already juggle 20+ SaaS tools. That changes how pricing needs to work.

Here is a simple “then vs now” view of SaaS pricing patterns:

| SaaS Pricing Aspect | Then (circa 2010-2015) | Now (2024-2025) |

|---|---|---|

| Main pricing unit | Per seat / per user | Usage-based, value metric (API calls, contacts, revenue managed, etc.) |

| Number of tiers | 3 simple tiers for all segments | Segmented packaging by size, use case, and motion (PLG vs sales-led) |

| Free plan | Generous free tier to drive volume | Constrained free plan or trials tied to activation milestones |

| Discounting | Heavy discounting to close logos | Structured discounts tied to contract length and expansion potential |

| Billing terms | Monthly by default, annual as upgrade | Annual standard for B2B, monthly priced at a premium |

| Pricing review cycle | Revisited every few years | Reviewed 2-4 times per year with experiments |

| Sales motion | Single motion: sales-led | Hybrid PLG + sales assist + enterprise sales |

Many SaaS companies still run with the “then” model in a “now” market. That gap kills expansion revenue and compresses margins. It also creates weird customer profiles: power users stuck in small plans, and hobby users sharing space with serious teams.

Classic SaaS Pricing Model vs Modern Usage Pricing

To make this more concrete, compare the mental model most teams started with to the structure that high-growth companies are moving toward.

| Pricing Model | Then: Classic 3-Tier Per-Seat | Now: Hybrid Usage + Value Metric |

|---|---|---|

| Anchor | Seat count | Volume tied to outcome (emails sent, records, revenue managed, etc.) |

| Customer fit | Good for simple internal tools | Better for tools tied directly to revenue or operations scale |

| Revenue potential | Plateaus once seat count stabilizes | Grows as customer usage and success grow |

| Sales story | “Pay per user” | “Pay in proportion to results and usage” |

| Risk | Heavy incentive to share seats or limit rollouts | Risk of billing surprises if not clear, but strong upside with fair design |

Per-seat pricing is not dead. It still works in categories like collaboration, project tools, or knowledge management. The problem starts when companies copy per-seat pricing into products where value tracks something else: GMV processed, messages delivered, hours saved, or deals closed. In those cases, per-seat locks you out of the upside your product creates.

Why Your Tiers Push Good Customers Into Bad Choices

Tier structure is often the main leak in a SaaS pricing model. A common pattern looks like this:

– Starter: too cheap, includes core features that enterprise buyers value.

– Pro: bloated, positioned to make Starter look better, but confuses actual buyers.

– Enterprise: “Call us”, with no public anchor or logic.

This structure makes sense on a whiteboard. On a real pricing page, it does three damaging things:

1. It teaches serious buyers to start low and upgrade later.

2. It hides your real revenue target behind a sales call.

3. It forces self-serve users to guess which plan fits their use case.

When the tiers map to feature bundles, instead of customer types or outcomes, you also get support headaches. A small team pays for enterprise reporting they do not use. A large customer stays on Starter, stacking integrations to replicate missing features, while you carry their load on small margins.

Investors look at the distribution of revenue across tiers. If 80 percent of your revenue sits in the lowest plan and the top tier is mostly window dressing, that is a sign the structure is off. It usually means one of two things:

– The mid and top tiers are mispositioned and overpriced relative to clear value.

– The entry tier cannibalizes everything above it because core value sits too low.

The “Good, Better, Best” Myth

Many marketing teams rely on the old “good, better, best” approach. It works in retail. In SaaS, the buyer journey is more complex. There are different jobs to be done, different internal buyers, and different time horizons.

A better way to think about tiers:

– Tier by customer type (individual, team, business unit, enterprise).

– Tier by complexity (simple workflows vs advanced automation).

– Tier by risk profile (self-serve vs those that need security, audit, legal review).

When you do this, you flip the conversation. Instead of saying “Choose your features”, you are saying “Choose your journey.” That language matches how real B2B buyers think and plan budgets.

Per-User Pricing: When It Works and When It Costs You

Many SaaS founders adopt per-user pricing because it is easy to explain. That is useful, but it can create long-term drag.

Per-user works when:

– Value is roughly proportional to number of users.

– Seat sharing breaks the product or reduces its value.

– Collaboration is the core of the tool.

Per-user weakens your revenue when:

– A small number of users create value for a large group (analytics dashboards, finance tools, AI engines).

– Usage volume, not headcount, is the value driver.

– Customers resist paying for “inactive” or occasional users.

The market shows a clear pattern: high-growth SaaS in categories like data, communications, marketing, or fintech tend to move away from pure per-user pricing and attach at least one usage metric.

For example:

– Email marketing: contacts stored, emails sent.

– Data platforms: rows processed, queries, storage.

– Support tools: tickets handled, conversations per month.

– Payments: GMV processed.

Linking price to usage gives you two key benefits:

1. Expansion revenue grows naturally with customer success.

2. Entry-level pricing can stay friendly while leaving room for large accounts to pay at real value.

The risk is bill shock. That is a product and communication problem, not a pricing concept problem. Good SaaS teams solve this with caps, alerts, and transparent calculators.

Why Your Free Tier Is Training Users Not To Pay

Free plans are common in SaaS, especially in PLG motions. They can be strong growth tools when they are designed with intent. Many free plans, though, are built around fear: “If we limit features, they will go to a competitor.”

The market indicates three recurring problems with free models:

1. The free tier includes the core value, not the “hello world” version.

2. The upgrade triggers are based on vanity features instead of success milestones.

3. The free user segment overwhelms product and support metrics, hiding the true signal from paying customers.

When the free plan is too generous, your best users settle into it. They invite teams, build workflows, and never feel a strong reason to upgrade. You then run growth experiments based on a user base that does not pay and may never intend to.

A better framing: free is not charity. Free is a structured, time-bound or scope-bound way to let the user reach an “aha” moment. That moment should feel like the first win, not the full journey.

Examples of better free design:

– Limit by time, but tie extension to activation milestones.

– Limit by scale (number of projects, contacts, seats) that naturally pushes serious teams up.

– Keep high-support, high-risk features (SSO, audit logs, advanced automation) behind paid plans.

This changes the revenue curve. Instead of a large base of static free users, you create a funnel where free feels like a trial of success, and paid feels like a step into scale.

Then vs Now: Free Plan Strategy

To see how this has shifted across the market, compare how SaaS free tiers looked in the first wave vs now:

| Free Plan Aspect | Then | Now |

|---|---|---|

| Goal of free | Brand reach and signups | Qualified product activation and upsell feeding sales |

| Feature access | Most features unlocked, soft usage caps | Core experience with clear walls before advanced value |

| Upgrade triggers | Feature FOMO (“Pro-only” tags everywhere) | Usage and success triggers (volume, team size, ROI points) |

| Sales involvement | Free segregated from sales motions | Sales assist for high-intent free users past a certain threshold |

| Measurement | Focus on signups and MAUs | Focus on PQLs, conversions to paid, expansion over 6-12 months |

“A free user who never hits a meaningful paywall is not a ‘lead.’ They are an unmonetized cost center with a login.”

Discounting: The Silent ARPU Killer

Discounts feel like a tactical tool, but repeated discounting shifts your price anchor in the customer’s mind. When every quote ends with “We can probably do 20 percent off,” the real price is the discounted one.

Investors look at new ARR per deal and compare it to list price. If every major customer sits far below list, they assume your pricing is out of sync with market reality or your sales process relies too heavily on concessions.

Problems with unstructured discounting:

– You train buyers to delay decisions until quarter-end, when they expect better deals.

– You confuse your own team about the real price position.

– You erode the perceived link between price and value.

Discounts are not bad on their own. They make sense when they buy you something clear:

– Longer commitment term (e.g., 2-3 year contracts).

– Prepayment.

– Volume or expansion commitments.

– Strategic case study or logo rights.

The key is to treat discounting rules like product specs. Document them, give sales a few clear levers, and tie each concession to a specific give from the customer side.

How Pricing Warps Your Customer Base

Pricing is not just about money per account. It shapes who comes in the door. That, in turn, shapes product roadmap, support load, and word of mouth.

Three common distortions:

1. **Tourist-heavy user base**

Pricing too low or free too broad pulls in casual users who are curious but not committed. Product fit looks worse than it is because many of your “users” never had serious intent.

2. **Enterprise in SMB clothing**

Underpriced high-value features attract large accounts that demand enterprise-level support while paying near-SMB rates. Gross margin looks worse at the top end, even though value delivered is high.

3. **Overfitting to early adopters**

Early pricing often reflects early adopter enthusiasm. Those users may accept complex per-feature pricing or tolerate quirks. As you move into the mainstream, the same structure confuses new buyers and locks out budgets.

This is where many founders feel stuck. Raising prices feels risky. Changing packages feels like breaking trust. But the alternative is quiet underperformance that compounds every month.

Then vs Now: What Pricing Signals To Investors

To understand why your pricing scares or comforts investors, look at how perception has shifted.

| Signal | Interpretation Then | Interpretation Now |

|---|---|---|

| Flat pricing for all segments | “Simple, focused go-to-market” | “Immature segmentation, risk of leaving enterprise money on table” |

| Heavy discounting across deals | “Strong sales hustle” | “Weak pricing thesis, fragile perceived value” |

| No usage component | “Easy model to scale” | “Limited natural expansion, risk of stalled NRR” |

| Static pricing page over multiple years | “Consistency for buyers” | “Lack of experimentation, maybe fear of market response” |

| Rich free tier | “Great for growth and virality” | “Need proof of conversion and monetization, concern on unit economics” |

Investors do not expect perfect pricing. They want to see an intentional loop: gather data, adjust pricing, measure impact, and refine. A complete absence of change over time suggests pricing is not getting the same rigor as product or marketing.

Common Pricing Mistakes That Directly Lose You Money

1. Copying Competitors Without Your Own Thesis

Founders often benchmark 3 to 5 competitors and pick a number in the middle. This tactic fills a deck slide fast, but it ignores your unique value, your cost structure, and your market position.

This leads to two problems:

– You anchor yourself to players that might be underpricing or mispricing themselves.

– You lock yourself into the same perceived category, even if your product solves a deeper or more urgent problem.

The better path is to use competition as a reference, not a ruler. You can charge more than peers if you can prove time savings, revenue impact, or risk reduction in concrete terms.

2. Pricing By Feature Count

Packing more features into higher tiers seems logical: more equals higher price. Buyers do not think in those terms. They care about outcomes and internal complexity.

Features that add complexity or risk for you, such as advanced permissions, compliance add-ons, or SSO, are strong candidates for higher tiers. Features that every serious user needs to succeed should not be scattered across plans.

When you mix these, you get odd structures like:

– Reporting locked behind enterprise, while basic security is in the cheap plan.

– Collaboration features locked away from individuals who actually need to share.

That confusion slows sales and pushes customers to cheaper plans that still give them 80 percent of what they need.

3. Underpricing On Day 1 And Never Catching Up

Many SaaS teams price low early to “get traction.” That is not wrong if you treat it as a launch phase. The problem appears when prices never move up, even as the product improves and brand trust grows.

Revenue then lags product maturity by 2 to 3 years. When you finally try to adjust, you face an installed base anchored on legacy numbers. Migrations become political, and your own team hesitates to propose price changes.

A healthier framing: early underpricing is a temporary trade for data and feedback. Set a review date and objective triggers for when and how to adjust.

4. Ignoring Regional and Segment Willingness To Pay

Selling the same plan at the same price globally sounds clean. Real willingness to pay varies by region, vertical, and company size. Currency differences, tax structures, and typical budgets all affect the perceived value of your price point.

If all your high-ARPU customers come from a handful of regions or industries, pricing that ignores those patterns leaves money on the table. Segment-based packaging or regional pricing can better match local realities.

Turning Pricing Into A Growth Lever

To stop losing money through pricing, you do not need a full overhaul in one go. You need a repeatable way to test, measure, and adjust. Think about pricing changes the way you think about product releases: with clear hypotheses, small experiments, and rapid feedback.

Practical moves that align with how the market behaves now:

– Introduce at least one value-based usage metric where it makes sense.

– Clean up your tiers so each one clearly matches a buyer type and level of complexity.

– Tighten the free plan around real activation, not endless usage.

– Standardize discount rules and tie them to clear trade-offs from the customer.

– Schedule pricing reviews every 6 to 12 months with a fixed process.

“You do not need perfect pricing. You need pricing that learns faster than your competitors’ pricing.”

SaaS companies that treat pricing as part of product strategy, not an afterthought, keep more of the value they create. The product earns the right to charge. Pricing makes sure the business actually collects.